The MATES Program has received approval from the Internal Revenue Service to change to a 501c3 non-profit public charity. Donors can now deduct contributions made to MATES under Internal Revenue Code (IRC) Section 170. MATES is also qualified to receive tax deductible bequests, devises, and transfers or gifts under Section 2055, 2106, or 2522 of the Code.

Any member or organization interested in making cash or training equipment donations, please contact the Executive Director at [email protected].

This change will also enhanced the Program’s ability to receive grants from government and private foundations.

MITAGS-MCC’s Nondiscrimination Policy can be viewed in its entirety at www.mitags.org/about-us and www.mccbwi.org/policy.html.

Related Posts

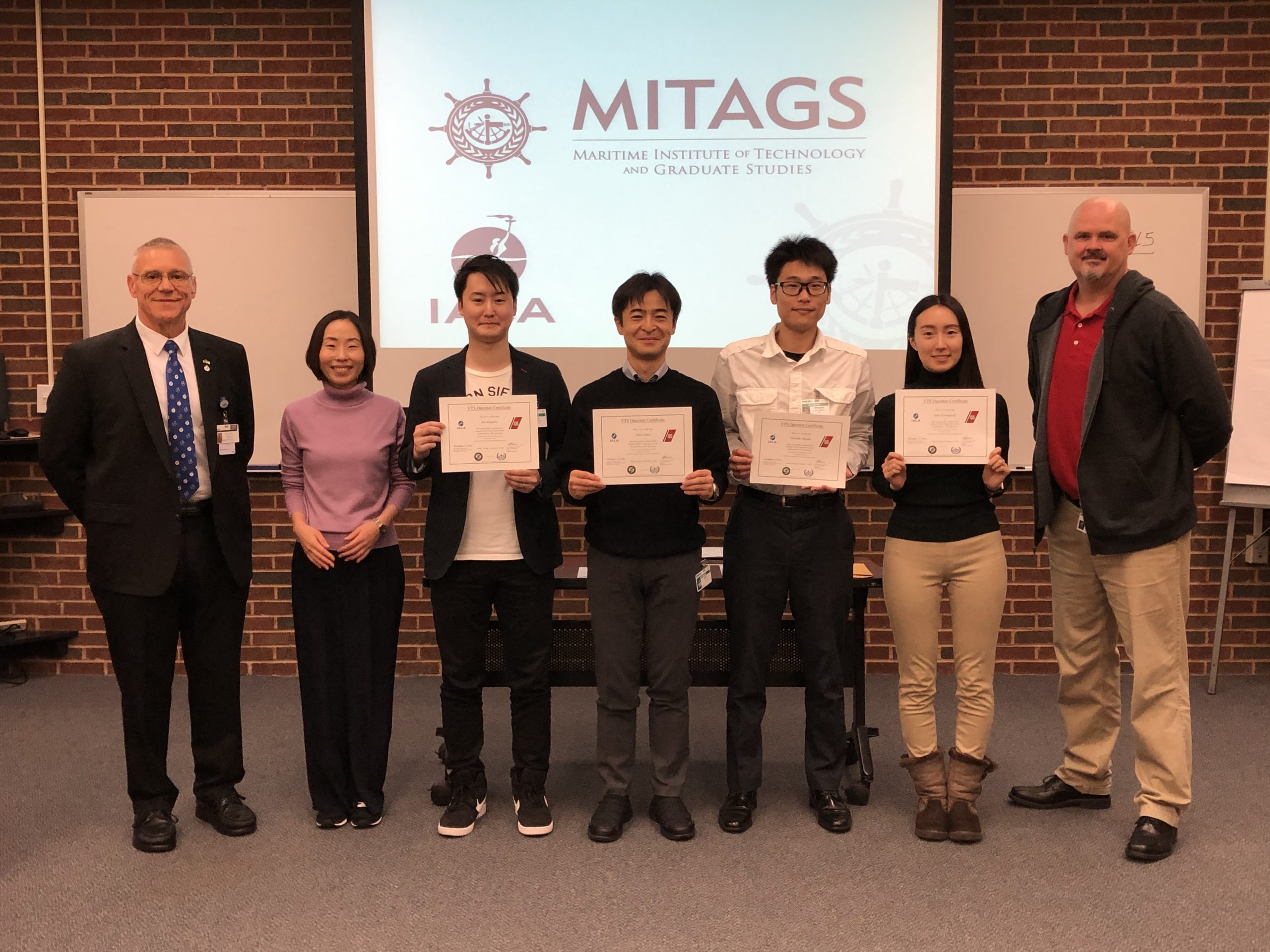

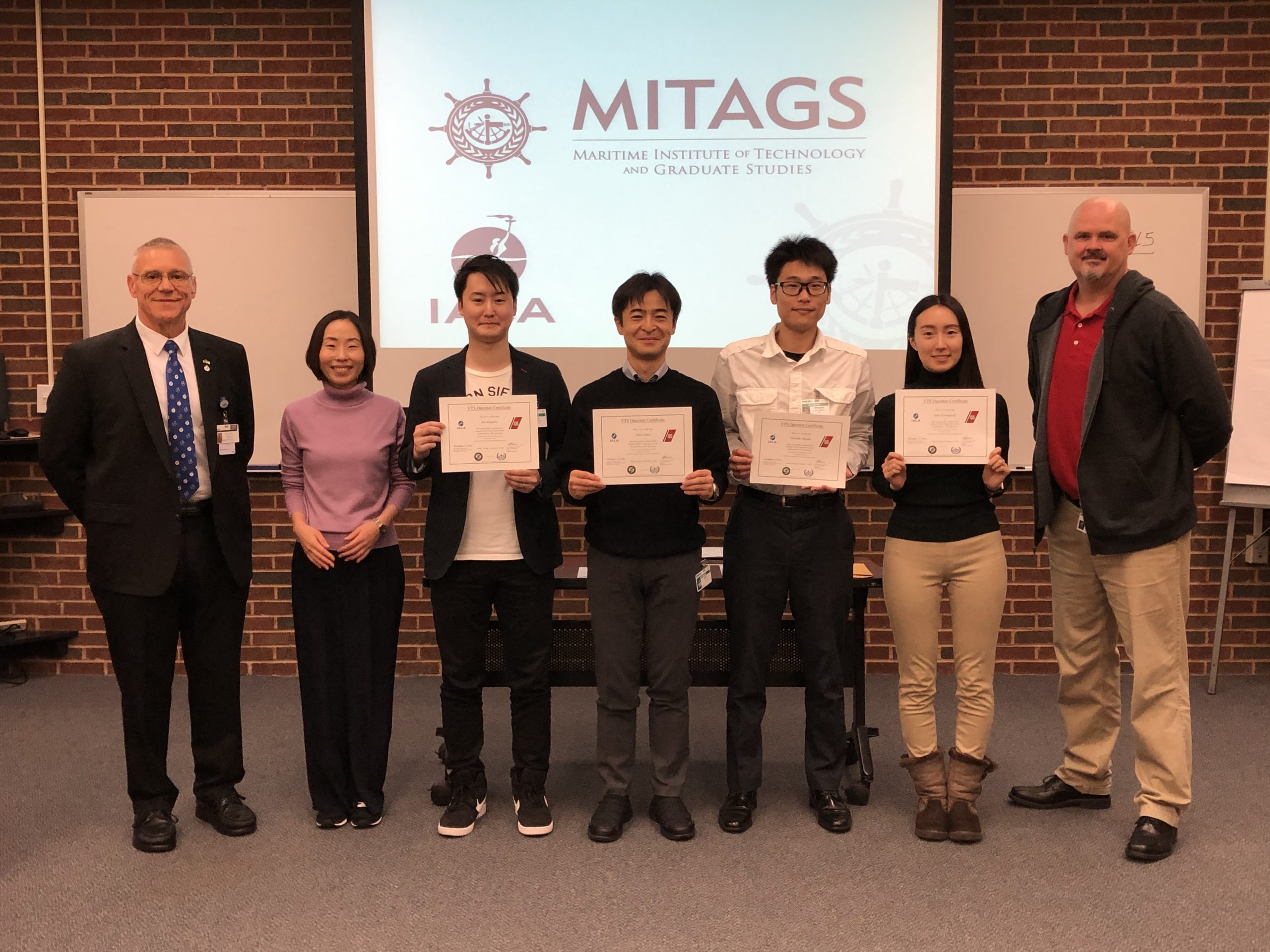

Last year, MITAGS hosted several operators from Japan’s Toyo Shingo Tsushinsha Corporation (TST) – or Toyo Signal Broadcasting Corporation when translated to English - for a two-week US Coast Guard Vessel Traffic Services (VTS) training program in Baltimore, Maryland. TST, again this year, sent several more of their operators for the two-week VTS training program.

The National Maritime Center (NMC) continues to experience increased Merchant Mariner Credential (MMC) and medical certificate application processing times. Every effort is being made to reduce these times and return credential delivery to within our stated performance goals. Here are important things YOU can do to streamline application processing...

Baltimore, MD – February 08, 2022 – The Maritime Institute of Technology and Graduate Studies (MITAGS) announces the appointment of Mike Rodriguez as the Interim Director of MITAGS. “I am pleased that Mike Rodriguez has agreed to take on the day-to-day administration of MITAGS’ academic programs and courses as we begin the process of bringing […]